DISCLAIMER: Snappy Title Loans is a dba of Bolt Loans, LLC. We are NOT A LENDER

and we

do not make short term cash loans or credit

decisions.

Loan amounts by the lenders vary based on your vehicle and your ability to repay the loan.

Since we do not lend money directly we cannot offer you a solicitation for a loan.

In all serviced states we WILL connect you with a lender based on the information you

provide on this website. We will not charge you for this service and our service is not

available in all states. States that are serviced by this Web Site may change from time

to time and without notice. Personal Unsecured Loans and Auto Title Loans are not available

in all states and all areas.

Auto Title Loan companies typically do not have pre-payment penalties, but we cannot guarantee

that every lender meets this standard. Small Business Loans typically do have pre-payment penalties

and occasionally will use your car as collateral to secure the loan.

All lenders are responsible for their own interest rates and payment terms. Snappy Title Loans

has no control over these rates or payments. Use of the term competitive or reasonable does not mean affordable, and borrowers should use their own discretion when working directly with the lender or partner.

The amount of people who applied for a loan and we helped and those who received a loan is not

the same. We cannot guarantee we will find a lender who will fund you. Just because you give us

information on this web site, in no way do we guarantee you will be approved for a car title loan

or any other type of loan. Not all lenders can provide loan amounts you may see on this web site

because loan amounts are limited by state law and/or the lender. Some lenders may require you to

use a GPS locator device on your car, active all the time. They may or may not pay for this or

charge you for this. This is up to the lender and we have no control over this policy of the lender.

Typically, larger loans or higher risk loans use a GPS.In some circumstances faxing may be required.

Use of your cell phone to receive updates is optional. Please review our privacy policy.Car Title

Loans are expensive and you may have other ways to get funding that is less expensive. These types of

loans are meant to provide you with short term financing to solve immediate cash needs and should not

be considered a long-term solution. Residents of some states may not be eligible for a loan.

Rejections for loans are not disclosed to our firm and you may want to contact the lender directly.

Car Title Loan lenders are usually licensed by the State

in which you reside. You should consult directly with these regulatory agencies to make sure your lender

is licensed and in compliance. These agencies are there to protect you and we advise making sure any

lender you receive money from is fully licensed.

Loan approval is subject to meeting the lender's credit criteria, which may include providing acceptable property as collateral. The APR for Snappy Title Loans is 29.90%-35.99% (varies based on credit requirements).

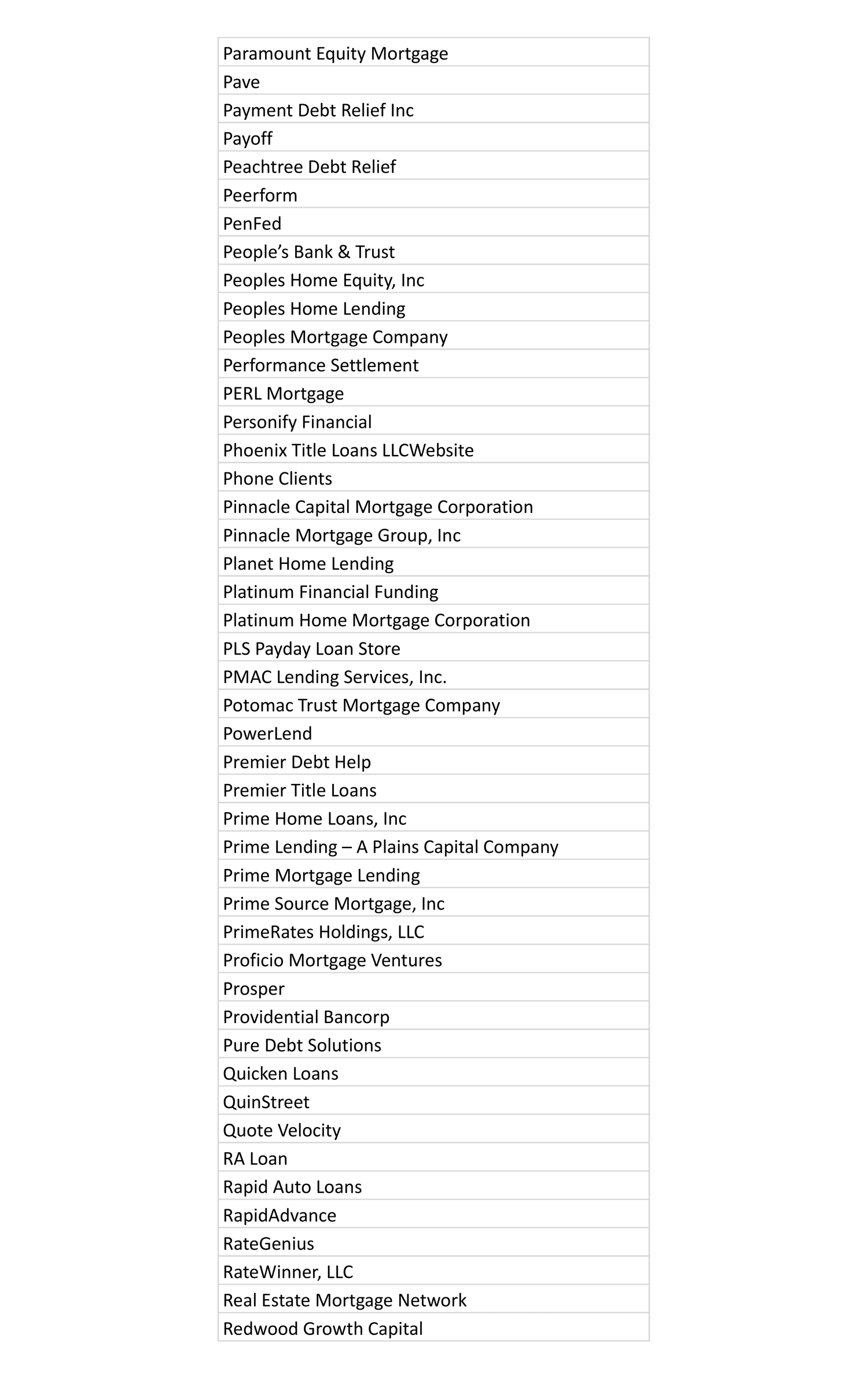

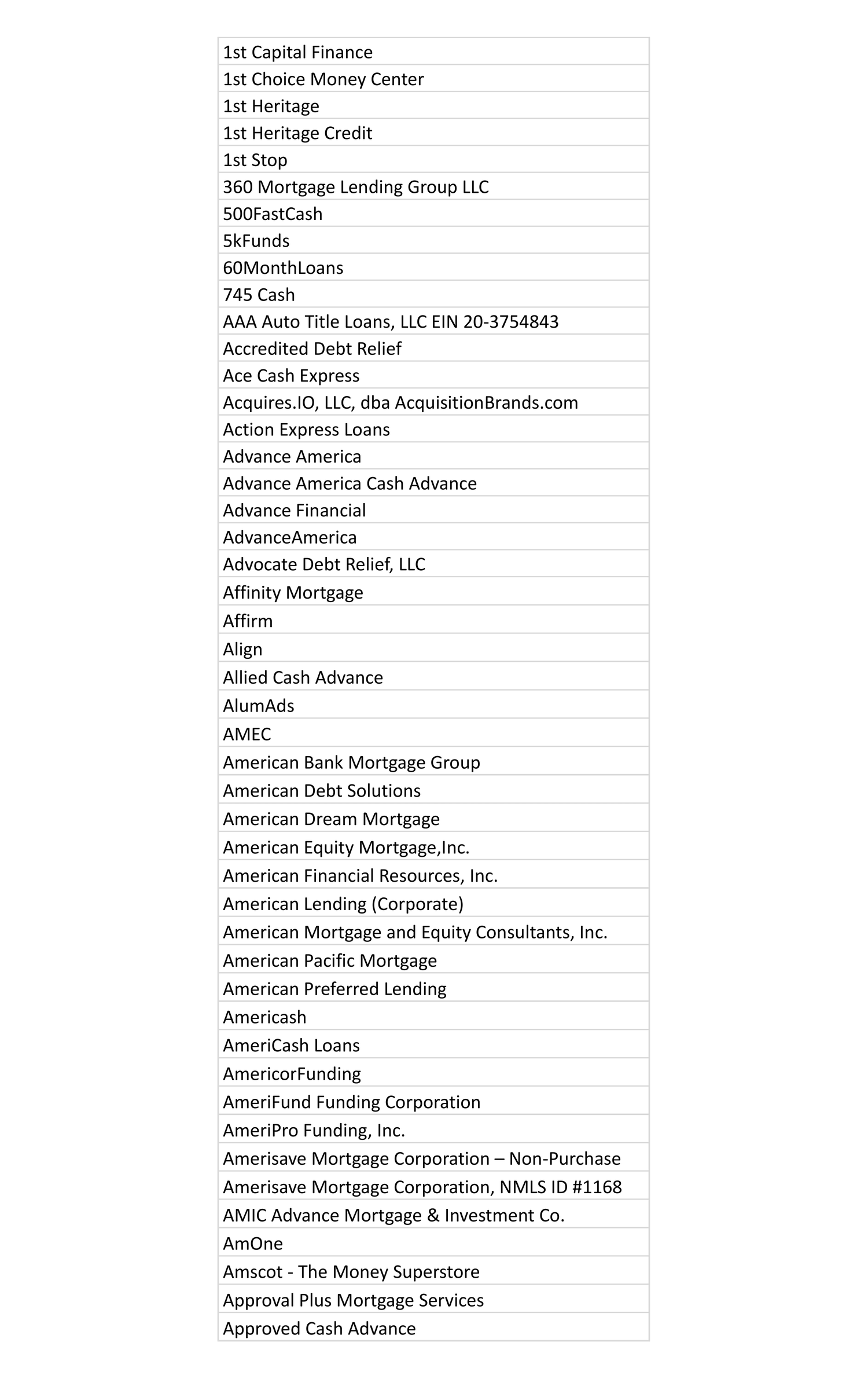

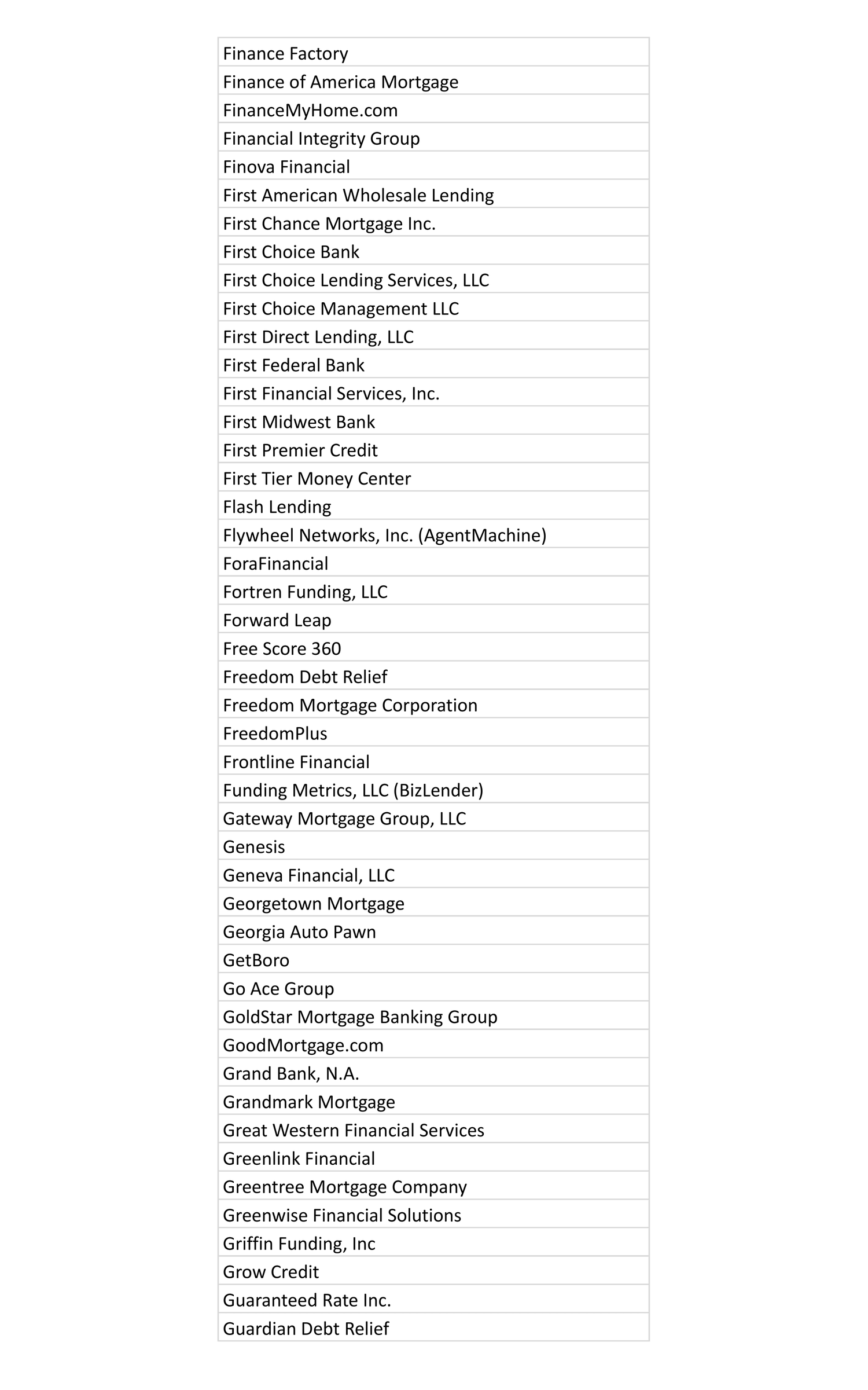

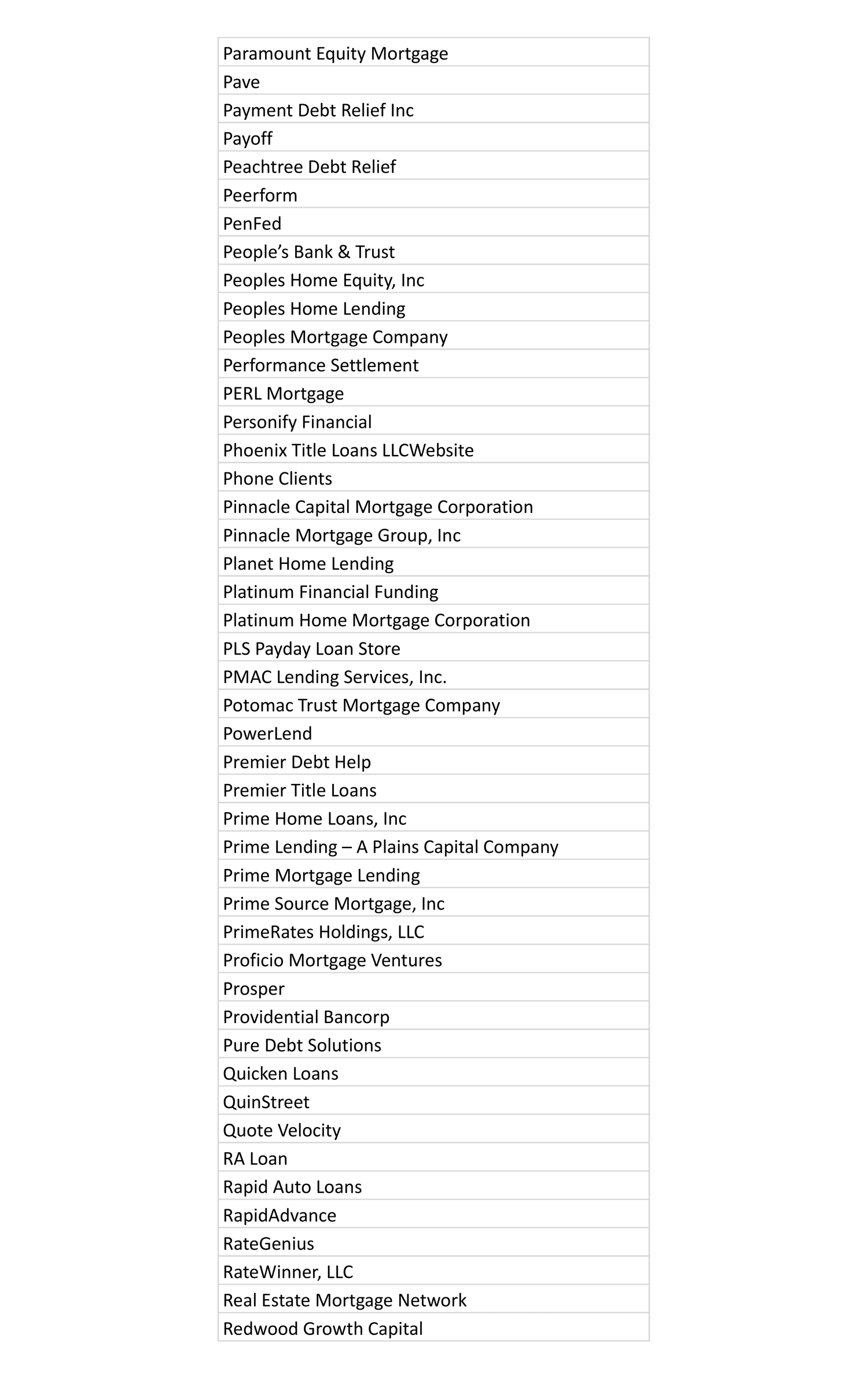

The chart depicted below shows the estimated cost of a premier loan for a borrower and provides an example of the repayment process for a car title loan. Repayment terms can range from 0 to 36 months. Actual loan amount, term, and Annual Percentage Rate (APR) a consumer qualifies for may vary based on factors such as their credit profile, state of residence, type of loan product, and the specific lender. Not all consumers are eligible for a premier loan product.

| Annual Percentage Rate |

Finance Charge |

Amount Financed |

Min Monthly Payment |

Total of Payments |

Number of Months |

| 35.89% |

$1049.80 |

$2525.00 |

$148.95 |

$3574.80 |

24 minimum |

| 34.87% |

$2052.05 |

$2525.00 |

$104.02 |

$4576.88 |

44 maximum |

Terms and conditions apply. All lenders are responsible for their own interest rates, origination fees, and repayment terms. Snappy Title Loans is not a lender and has no control over these rates, fees, terms, or payments.

Below are factors that impact the borrower’s ability to qualify for a premier loan product:

1) 675 FICO score or higher

2) Collateral of $5000 or higher as per trade in value on BlackBook

3) Demonstrate Ability to Repay The Loan

4) Clear Title